Buy a property in Thailand – 101 – updated 2023

In this comprehensive guide, as Thailand Real Estate and Property Investment Specialists, we’ll leverage our experience at Keller Henson and we’ll share our insights, having successfully facilitated the sale of over 150 properties in Thailand to international clients. Our aim is to simplify the process for you, outlining clear, easy-to-follow steps to navigate the complexities of purchasing property in Thailand as a foreigner. This article is a summary of our in-depth knowledge and proven strategies in the Thai real estate market.

1. How can foreigners buy a property in Thailand?

Thailand is a popular destination for foreigners willing to purchase a piece of real estate, the real estate average market price is quite accessible and the returns on investment are assured by a strong tourism industry. Thailand has so much to offer to foreigners, including a wide range of real estate opportunities for secure property investments. But how can you buy real estate in Thailand as a foreigner, non-resident in Thailand, from overseas, without even coming to Thailand? Rest assured, that is totally possible and legal to buy a property in Thailand as a foreigner remotely, from overseas, from the booking to the final registration and handover without coming to Thailand, and Keller Henson, real estate agent and property investment specialist in Thailand, gives you here after in this guide to purchase a property in Thailand all the insights you need to handle it like a pro.

1.1 Buy a property in Thailand : leasehold terms vs freehold terms

Thailand is a kingdom favorable to foreign investments and under applicable Thai laws, the origin of funds to purchase a property as a foreigner must come from overseas in a currency else than Thai Bahts (THB), non-residents are allowed to buy a property in leasehold terms only, and in freehold terms for condominiums within the ‘foreign quota’ only.

1.11 Buy a house or a condominium in Thailand in leasehold terms

Buying a property in leasehold terms means that you are granted a long term lease, usually a maximum 30 years lease, possibly renewable. You are therefore the lessee in the leasehold contract terms, the full owner of the property is the lessor. Technically, you are not the owner of the property, but you get the benefits and rights over the property for the time of the lease, and you can possibly resell anytime by transferring your lease to another buyer. The leasehold ownership terms come with fewer registration taxes at the Land department – as opposed to freehold terms. We recommend that when buying a house or a condominium under leasehold terms, the lessor is contractually a limited company and not an individual. ![]() See leasehold terms

See leasehold terms

1.12 Buy a condominium in Thailand in freehold terms

Buying a property in freehold terms means that you are granted the full ownership rights of the property, for an unlimited period of time. Your name appears on the title deed (chanote) of the unit as the sole and full owner of the property, duly registered at the Land department. Buying in freehold terms for a non-resident is only possible when buying a condominium unit with enough foreign quota. The foreign quota, the part of foreign investments in one condominium by surface shall not exceed 49% by law. Buying a condominium in freehold terms comes with higher transfer and registration taxes payable at the Land department as opposed to leasehold terms. ![]() See freehold terms

See freehold terms

1.2 Buy a house or a condo in Thailand 101

As per what we have just outlined above, purchasing a house, a villa or purchasing a condominium in Thailand suggests there’s a difference in ownership conditions and terms. Houses for sale or condominiums for sale in Thailand can possibly undergo 2 different buying processes based on the 2 different possible ownership terms for foreigners : leasehold terms or freehold terms.

1.21 Buy a condo in Thailand

According to the Thai Condominium Act of 1991, it’s possible for foreigners to own a condominium unit in freehold terms only if more than 50% of the co-ownership in the condominium is Thai. To say it differently, the percentage of the total surface area held by foreigners in a condominium must not exceed 49% of the total surface area. These 49% allocated to freehold ownership, allow for non-residents to buy a condominium in freehold terms. Out of the foreign quota, a condominium unit can only be purchased in leasehold terms by a non-resident. Anyhow, the funds to buy a condominium in Thailand, in freehold or leasehold terms must come from overseas in a different currency than THB

There’s obviously a preference from foreign investors to buy condominiums in freehold terms, for the sake of the security to have their names as full outright owners on the title deed, but it also comes with a surcharge in most cases. Most of the condominium developers will apply a so called “freehold surcharge” to the condominium unit purchase price if you would like to buy the condominium unit under freehold terms. On the other hand, buying a condominium in Thailand in leasehold terms also often makes sense when purchase prices and registration fees are fewer, condominiums for sale in Thailand start as low as 1 Million THB and the most expensive penthouses in Bangkok are over 400 millions THB.

1.22 Buy a house or a villa in Thailand

Thailand’s house and villa market is very dynamic, with property transfers to foreigners set to rise by 65.6% in the first half of 2023. This is not surprising, since Thailand’s lifestyle, magnificent landscapes and attractive rental yields attract many investors, as well as many foreigners willing to relocate every year. Houses and villas prices for sale in Thailand vary greatly depending on the province. The housing market in Thailand is extremely wide, from properties valued at less than a million THB to luxury beachfront villas valued at over 200M THB. The list hereafter is non exhaustive, and gives an idea of available houses and villas for sale in Thailand.

All house and villa types can only be purchased under leasehold terms by foreigners. When you buy a house or a villa in Thailand, although the building structure can maybe in some conditions be purchased in freehold terms, the house sits on a piece of land that can only be purchased in leasehold terms for a non-resident. The funds to buy a house or a villa in Thailand, in freehold or leasehold terms must come from overseas in a different currency than THB. Unless you can buy the house or villa with a Thai limited company . ![]() See buy a property with a Thai limited company

See buy a property with a Thai limited company

1.3 Buy off Plan properties in Thailand

Another type of property investment in Thailand consists in buying off-plan properties. This means buying a condominium unit or a house or a villa before it has been erected out of the ground. Buying properties off-plan allows you to achieve substantial discounts and potential long-term capital gains, since “pre-sale” purchase prices are lower than the average market. The risks associated with buying a property that is not yet tangible are offset by the preferential rates and payment flexibility. Depending on the estimated completion date, it is likely to get flexible payment terms over the course of the property construction. Payments can be made as per construction progress or as per schedules, upon contracts. In practice, an off-plan property investment is often spread over few payments over the course of one or several years. The funds to buy an OFF PLAN property in Thailand, in freehold or leasehold terms must come from overseas in a different currency than THB

1.4 Property investment in Thailand

Property investments account for a huge share in Thailand foreign investments. The dynamic hospitality industry and luxury properties offer multiple opportunities to investors. You can possibly purchase in Thailand a property within a hotel, and get a return, guaranteed or pooled, per year, based on the unit purchase price, and other benefits, including free stay in your unit, buy back option after a few years etc. You can always invest and purchase any property and rent it out by your own means or by contracting a professional rental management company. Watch out, Airbnb is not permitted everywhere in Thailand. Contact us if you would like to be guided in property investments in Thailand.

Rental programs offered come with peace of mind, freeing you from administrative, customers relationship headaches and guarantees you a return every year.

- Guaranteed rental program means that you can anticipate your return on investment (ROI) since it is part of the Sales and Purchase Agreement and fixed to a certain percentage . Example, a guaranteed rental program with 7% net per year, would give you 7% of the unit purchase price per year. Another significant advantage of the guaranteed rental programs is that you benefit from free stay in your very unit, which means you can occupy your property for 15 to 30 days free of charge during the year and get your investment return at the end of the year. A nice blend of investment and personal use.

- Rental pool program means that you cannot anticipate your return, it is not guaranteed, on the other hand, it is not capped either. A pool rental program consists in pooling together all the rental revenue generated from all owners and then redistribute it equally at pro-rate per square meter owned among all owners minus a share for the management. The rental pool program guarantees somehow a minimum revenue, independently from renting out your very property, while not being capped to a maximum return. In practice and average, pool programs allow for greater returns than guaranteed revenue.

1.5 Buy land in Thailand as a foreigner

It is restricted for a non-resident to own a piece of land in Thailand. This means you can get a plot of land in Thailand as a non-resident only in the form of a long term lease, in leasehold terms outlined above for a specific amount of time. You can afterwards build a house or a villa on the land you have been granted with a long term lease. The lease contract for the land is to be registered at the Land department. The funds to buy a land in Thailand, as a foreigner must come from overseas in a different currency than THB

1.6 Buy a property in Thailand with a Thai limited company or offshore company

Another practice consists in buying a property under the name of a Thai company. A local Thai limited company or even an offshore company. This requires obviously extra legal set up and maintenance fees as well as compliance with law.

1.61 Buy a property in thailand with a Thai limited company

The main advantage to buying a house with a Thai limited company as a foreigner, is to purchase the land under freehold terms, as a local Thai entity and not in leasehold terms as a non-resident. Thai companies, by law, limit foreigners to a maximum of 49% of shares, technically, to keep the control of your Thai limited company, you will need to have enough Thai shareholders to share with and remain in majority, generate incomes, and pay taxes yearly, without mentioning again the legal assistance and maintenance fees it requires.

WARNING – In Thailand, to use nominees without an active evidence of business roles in a company is illegal, so involving genuine shareholders who participate in the company’s activity is mandatory to remain legal and compliant when buying a property with a Thai limited company.

1.62 Buy a property in Thailand with an Offshore company

An offshore company is considered as a foreign entity and so foreign ownership conditions apply when you want to buy a property with an offshore company. It is therefore possible to purchase a property in Thailand with an offshore company in leasehold terms or in freehold terms within the foreign quota for condominiums only. You will need to show evidence of the following documents translated into Thai and notarized at the embassy consulate in Thailand, these documents are valid for only 30 days for the transfer of ownership from the date of legislation.

2. Purchase a property in Thailand with peace of mind with Keller Henson!

Buy a condo or buy a villa in Thailand smoothly and risk free by following these easy steps and pieces of advice from our experience about real estate in Thailand, this will save you a precious time. Purchasing a property in Thailand is a quite simple and straightforward process but you need to make sure to follow a guideline to comply with Thai real estate foreign investment policies.

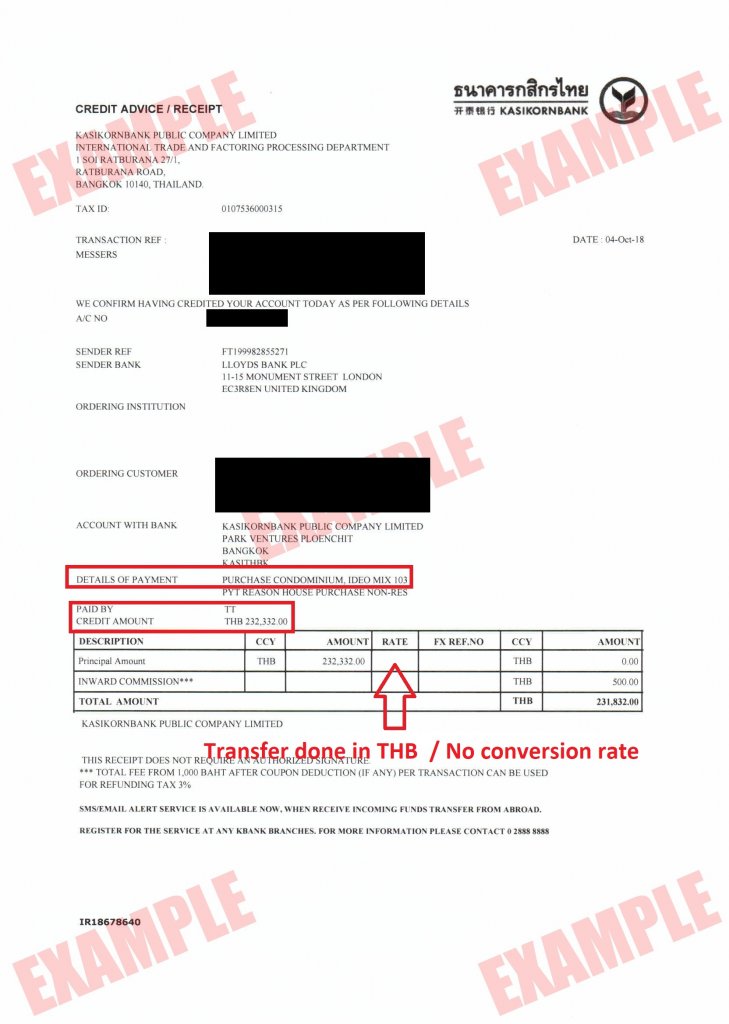

First and most important aspect is financial, how do I pay? Who shall I pay? When you buy a property in Thailand, it is paramount, to comply with Thai laws in regards to foreign investments, primarily, the funds to purchase a property must come from overseas in a foreign currency, before being converted and exchanged into Thai Bahts (THB). In practice, it means that as you transfer the funds to a Thai bank account to purchase a property, you have to make sure to transfer the funds in a currency other than THB, and let the beneficiary bank in Thailand do the conversion at its exchange rate into THB. In practice again, and depending on the type of property, new or second-hand property, you might have to send the funds directly to the bank account of a local property developer or to a personal bank account, respectively. In both cases, to proceed at the Land department with the official registration of a property, Credit Advice or FETF to prove the origin of the funds and a Letter of Reference must be presented.

For each transfer, banks will only provide a “Foreign Exchange Transaction Form”(FETF) certificate for amounts of over US$ 50,000. For lesser amounts, the bank will issue a credit advice, which have to be presented, with the confirmation letter from the bank, to the Land Office in order to register the property and comply with foreign investment policy in Thailand. See more below

2.1 Buy a property in Thailand from a property developer

When you buy a new condo or a new villa or an off-plan property, you are most likely dealing with a company in charge of the construction, sales, and management of the property: the property developer. In this case, and upon payment terms agreed, you can possibly transfer the funds to purchase the property directly to the developer’s bank account through an international bank transfer. The bank transfers must be made in a foreign currency with a clear description along with the payment describing the purpose as follows:

PAYMENT INTRUCTIONS WHEN TRANSFERRING FUNDS TO PURCHASE / LEASE A PROPERTY IN THAILAND

TO PURCHASE (NAME OF PROPERTY OR CONDO – UNIT NO ) ON BEHALF OF (BUYER’S FULL NAME)

TO LEASE (NAME OF PROPERTY OR CONDO – UNIT NO ) ON BEHALF OF (BUYER’S FULL NAME)

CAUTION: Wording matters, for the Land Department, the word “apartment” and “condominium” refers to two different unit types. Foreigners can possibly buy in freehold terms condominiums, while apartments would be in leasehold terms only.

When you purchase an off-plan property for instance, and depending on payment terms, you might have several transfers to do over the course of a year or two. In this case, every bank transfer with partial amounts shall be made with the same above instructions. The property developer’s bank will take care of the paperwork to be presented at the Land office to show origin of the funds. ![]() See : FETF + Letter of Reference. Nevertheless, if you prefer, you can always transfer to a personal bank account of yours in Thailand before paying the property developer.

See : FETF + Letter of Reference. Nevertheless, if you prefer, you can always transfer to a personal bank account of yours in Thailand before paying the property developer.

2.2 Buy a property in Thailand with a personal Thai bank account

If you prefer, or when you buy a second hand property, you are most likely dealing with an individual owner, there is obviously a huge risk transferring upfront to any individual any amount of money without ownership’s transfer guarantee. It is therefore recommended, to transfer the funds to a personal bank account of yours in Thailand, in a foreign currency. So you can pay afterwards an individual with a cheque endorsed from your bank against the transfer of ownership at the Land department.

PAYMENT INTRUCTIONS WHEN TRANSFERRING FUNDS TO PURCHASE / LEASE A PROPERTY IN THAILAND

TO PURCHASE (NAME OF PROPERTY OR CONDO – UNIT NO ) ON BEHALF OF (BUYER’S FULL NAME)

TO LEASE (NAME OF PROPERTY OR CONDO – UNIT NO ) ON BEHALF OF (BUYER’S FULL NAME)

When you buy a villa or a condo through your personal Thai bank account, you need to obtain by yourself, from your bank, the necessary forms to be presented at the Land department that justify the foreign origin of the funds and a letter of reference from the bank with details of the property you like to purchase. ![]() See FETF / Credit Advice

See FETF / Credit Advice

Can I open a bank account in Thailand?

Yes, you can, when you buy a property in Thailand to make it simple. It is true that for security reasons, opening a bank account in Thailand for a non-resident is getting challenging. Rest assured, in most cases, with few major local banks, you will be able and entitled to open a bank account if you can justify that you own, or will own anytime soon a property in Thailand. The following set of documents must be presented to the bank:

You have a Thai bank account, a debit card, and access to the banking Apps, enabling you to pay or withdraw money anywhere in Thailand. Keller Henson is always happy to assist you with opening a bank account at some foreigner-friendly banks.

2.3 Can I purchase a property with crypto-currencies in Thailand?

Thailand does not support the cryptocurrencies as a foreign currency in regards to foreign ownership. However, with the help of a broker associated with a Thai bank , to issue the FET form, You can possibly buy a villa or a condo with a payment made with cryptocurrencies.. ![]() See FETF / Credit Advice.

See FETF / Credit Advice.

Keller Henson can assist and guide you if you would like to purchase a property in crypto, most cryptocurrencies accepted are: Bitcoin, Tether and Ethereum, respectively: BTC, USDT, ETH

2.4 What payment terms when buying a property in Thailand?

Payment terms remain at the sole discretion of the property developer or the individual seller. Payment terms when you purchase a property in Thailand are an entire part of the Sales and Purchase Agreement (SPA), consisting usually in an initial deposit acting as a reservation fee, followed by a payment in full or installments as per schedules or construction progress.

2.41 Deposits

The deposits are reservation fees to book a villa or a condo in Thailand for a certain period of time, in average 3 to 5 weeks, so there’s enough time for the parties to agree and sign the sales and purchase agreement. The deposits made are very rarely refundable. The deposit amount depends on the final price of the property but is ranging between 50,000 to 250,000 THB on average.

2.42 First down payment and installments (applicable for off-plan properties)

Once the Sales and Purchase Agreement is signed, the first down payment will come on schedule, and can represent 35% or more of the total price of the property. The other payments are installed as per schedules of payment agreed or as per specific construction progress : land preparation, piling, start of concrete structure, structural completion, registration at Land department and handover. The property developer usually issues monthly work progress reports and construction progress steps are contractual.

2.43 Final Payment and Transfer of Ownership

Legally in Thailand, a property is to be transferred officially to a new owner at the Land department only when the property has been fully paid. When you buy a new villa or a new condominium, the final payment in the balance to the property developer allows you, providing you have paid in advance all other charges, to get the registration of your property at the Land department. ![]() See all extra charges explained

See all extra charges explained

When you buy a second-hand property from an individual, you must prepare ahead of the Land department appointment day of transfer, a cheque endorsed from your Thai bank to the seller’s name for the amount of the property minus the deposit. This cheque will be held at the Land department as an evidence of the payment to process further with the official registration – transfer of ownership of the property.

2.5 Registration / transfer of Ownership at the Land department

Every real-estate property in Thailand must be duly registered at the Land department, and transfer fees are to be paid at the Land department upon registration / transfer. This final and utmost step ensures your property is officially in the books, and that you are tax compliant in Thailand.

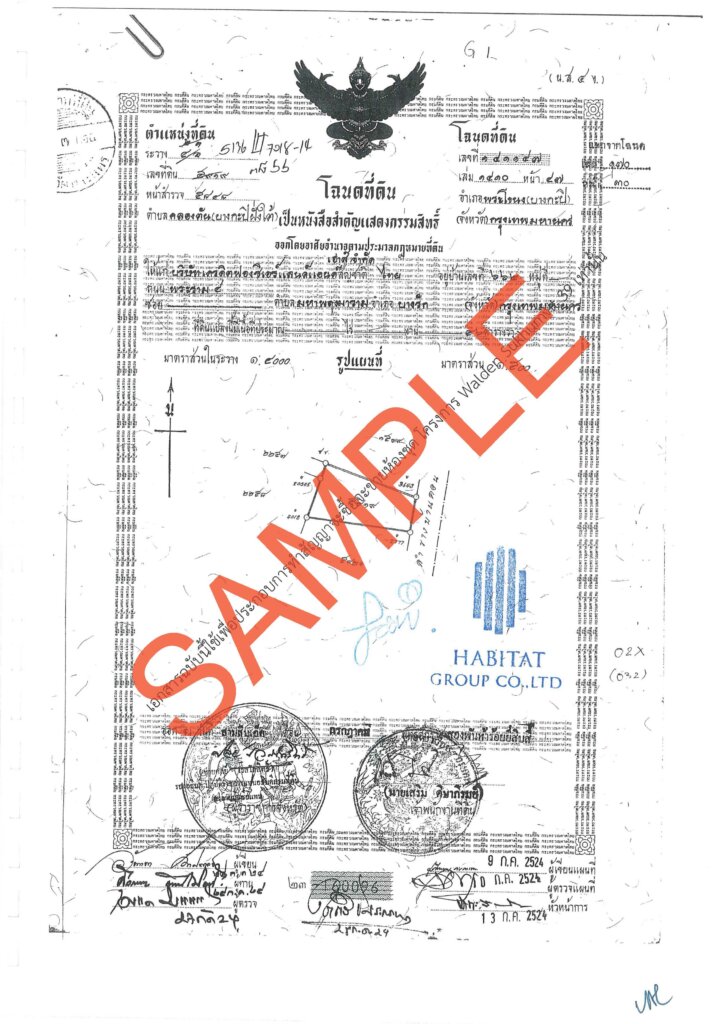

In Thailand, properties have a booklet called “Tabian Baan” – yellow colors for foreigners, that register the owners of the property. This is what you get at the Land department after successfully registering your property. If you have purchased a condo in freehold terms, you will also receive one original title deed where your name appears in Thai, also known as the “chanote”. These 2 documents, title deed and “Tabian baan” in Thailand are ultimate evidences of your property ownership and might be needful for other administrative tasks or even visa purpose. ![]() See Title deed / Chanote

See Title deed / Chanote ![]() See Transfer fees

See Transfer fees ![]() See Real Estate Taxation

See Real Estate Taxation

2.6 EXTRA CHARGES explained when you buy a property in Thailand

All other extra charges explained: when buying a property in Thailand : CAM fees, sinking funds, Elec/Water meters installation

3. Before purchasing a property in Thailand!

3.1 Due diligence of the property

At Keller Henson, all real estate properties listed in the website have already passed through an internal due diligence process. A few safety checks you want to do, before you purchase any property in Thailand. Due diligence process goes through analyzing the property developer’s profile, reputation, financial stability, tracked records, the status of the project’s building and environmental permits, and of course, who ultimately owns the land. Thailand is sadly the theater of never completed elevated highway concrete blocks or skyscrapers’ skeletons in Bangkok, and this shall call for extreme caution when buying a house or a condo in Thailand, as a reminder, that this first due diligence work is to be taken very seriously. Our team of real estate professionals is on hand to support you, doing due diligence work ahead, and helping you understand and identify best purchasing options avoiding potential long-term risk clauses along the way.

3.2 The EIA permit

Any property development in Thailand must comply with Thailand’s Environmental and Industrial Act – The EIA permit – This law allows for regulation and acceptance of the construction plans and architecture ahead of the construction. The EIA permit is a must have as part of the Sales and Purchase Agreement Annexes.

3.3 The Building Permit

3.4 The Land Title Deed

Also known as a “chanote”, the title deed indicates who is the owner of the land on top of which your property is built. It provides crucial information, for example, whether the land is mortgaged to the bank. When buying a house, villa or a condo, it is preferable and recommended that the property developer is also the owner of the land in the land title. A copy of the Land title deed must be part of the Sales and Purchase Agreement Annexes.

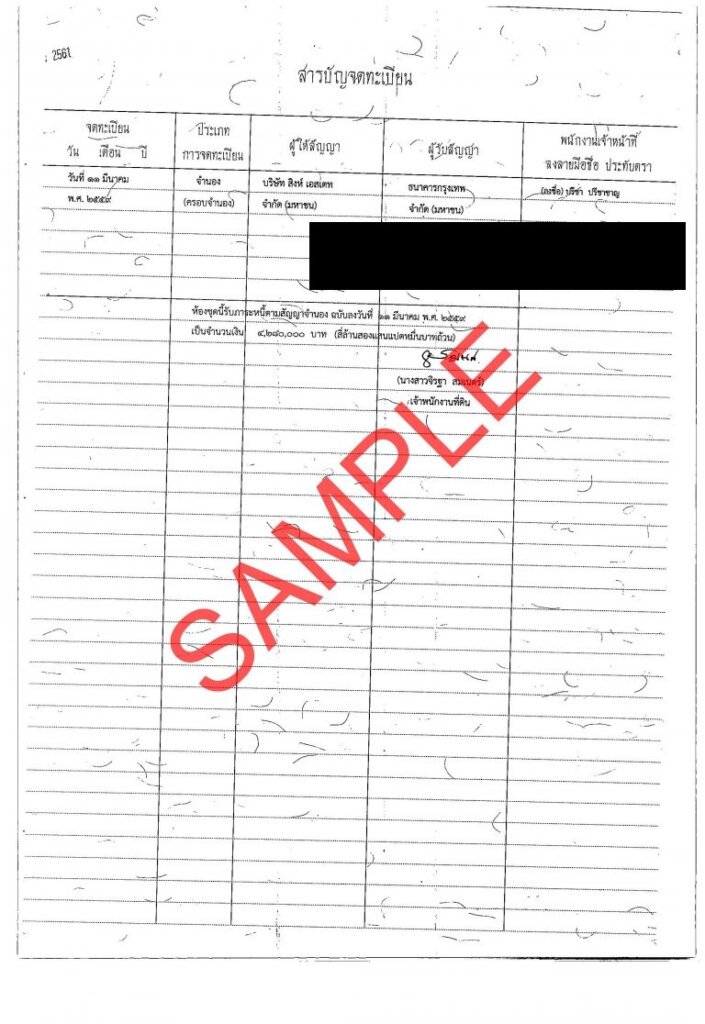

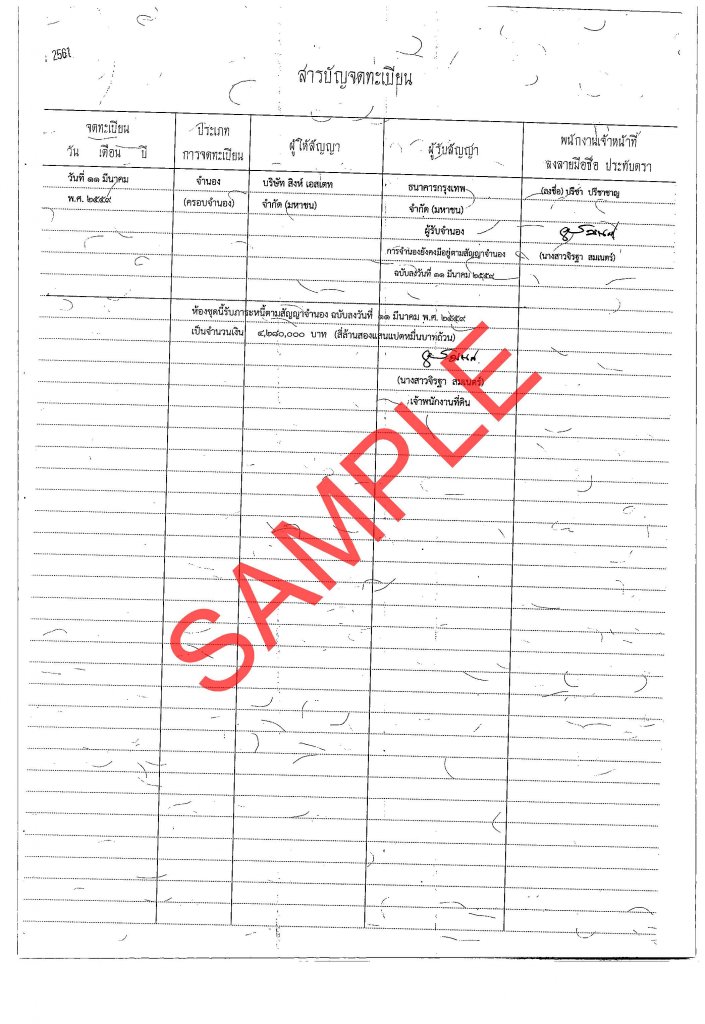

3.5 The Developer legal company documents

Also known as an affidavit, this is a company’s official registration document. It contains the most important information, such as the company’s identification number, company capital. It also contains other legal information such as the company’s address, authorized signatory, director names. This ensures you to check on the status and compliance of the property developer towards Thai laws. Must be part of the Sales and Purchase Agreement Annexes.

3.6 The Director(s) ID copy

Not sure where to start? Keller Henson is here to help you every step of the way. As real estate specialists, we do all the due diligence work for you, ensuring a safe and secure real estate investment in Thailand.

4. Checklist of documents when you purchase a property in Thailand

Due diligence work of the property is done, here after a checklist of documents you will need to have in hand or to be reviewed at some point when you purchase a villa or a condo in Thailand.

4.1 The Quotation

The quotation precedes the Sales and Purchase Agreement and remains an integral part of the buying process since it recaps the early conditions of the property purchase, including the deposit amount, the total price of the property, ownership conditions, discounts if any, unit no, surface area, etc. A reservation agreement can be issued and signed, acknowledging the receipt of the first deposit. The quotation ends up as part of the Sales and Purchase Agreement Annexes.

4.2 The Sales and Purchase Agreement (SPA)

This is the official contract between the Buyer and the Seller, the SPA prevails over the quotation if terms ever differ. The SPA can be in English, governing under Thai applicable laws. Assistance of a lawyer or public notary is not mandatory in Thailand, nevertheless you can possibly review together with a lawyer you can hire. Each page must be signed by both parties. Keller Henson is more than happy to assist and review for you the key clauses of your SPA when you buy a villa or a condo.

When buying a property off-plan, and to protect your future interests, the Seller’s engagement in a date of completion and handover date must be stated in the SPA, along with a penalty clause in the event of a delay. The same goes for the payment installments from the Buyer over the construction period, subject to penalties in the event of payments out of agreed schedules.

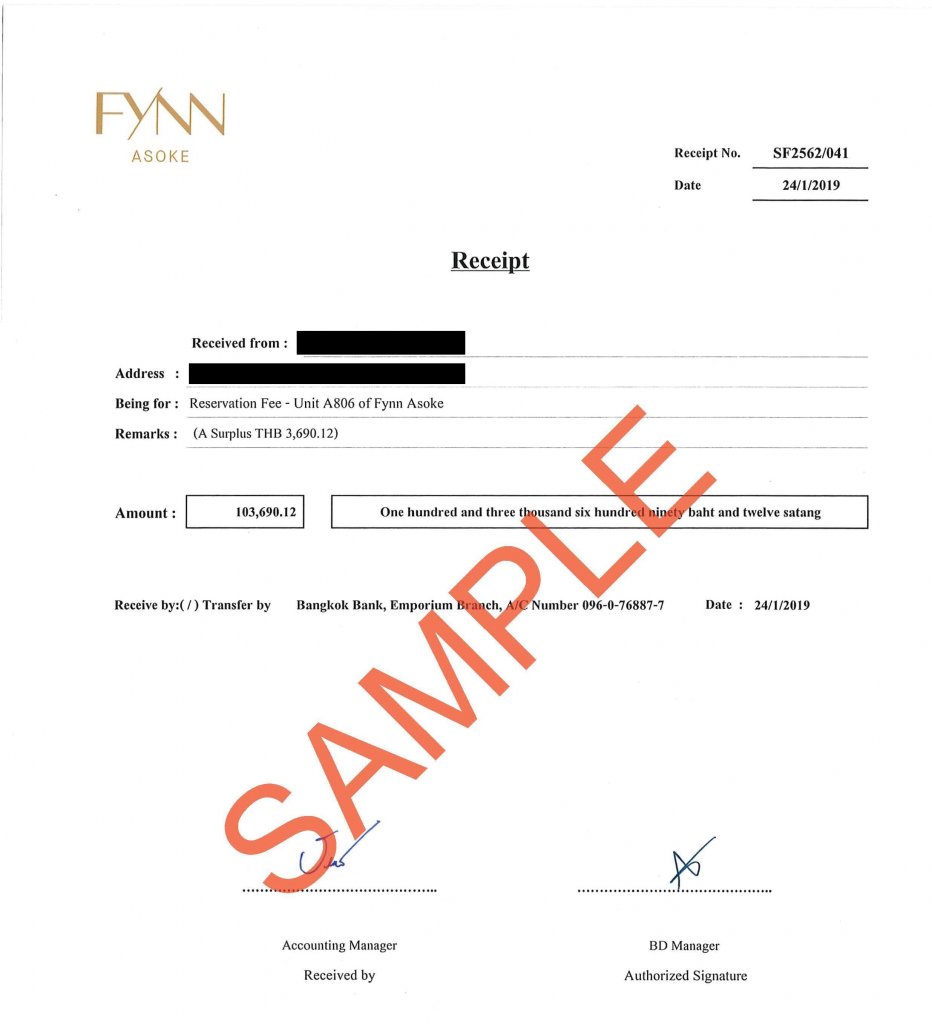

4.3 The Official Payment Receipt(s)

The property developer will issue a receipt anytime you transfer money, from the deposit till final payment. You can request when a payment is made to get a copy of the official receipt from the bank. These official bank receipts allow you to see the applicable exchange rate in THB of the beneficiary bank in Thailand.

4.4 The Credit Advice / FETF

For every transfer of funds to a Thai bank, the beneficiary Thai bank issues a credit advice document proving the origin and amount paid in. When purchasing a property in Thailand, a foreigner must prove funds are coming from overseas in a foreign currency. To prove it, the beneficiary bank in Thailand who received and exchanged the funds into THB must issue a credit advice or a Foreign Exchange Transaction form (FET or FETF) depending on total amount.

The FETF document is holding 2 names, the name of the sender of the funds overseas and the name of the receiver of the funds. It is mandatory that one of those 2 names (sender or receiver) is the buyer. The transfer description shall also clearly indicate the property name and the condominium unit to be purchased:

4.5 The Bank Guarantee Letter – Bank Reference Letter

Usually to be issued at the same time with the credit advice or FET form by the beneficiary bank, the letter accompanies the credit advice / FET form, engages the bank’s responsibility and specifies the name of the buyer, the total amount received in foreign currency with dates and stamps to proceed at the Land department

4.6 The Title Deed / Chanote

The title deed, also known as chanote, is the official proof of an outright ownership of a property or land in freehold terms. In other words, a foreigner will get a title deed with his/her name on it ONLY when purchasing a condominium in freehold terms.

The title deed consists of 2 originals, one with the owner, one at the Land department, both originals are needed to intent any changes – transfer of ownership.

The chanote gives details and a layout of the property / condominium unit / land, along with other crucial relevant information: total surface area, floor, etc…

The title deed – chanote might be requested for administrative purposes in Thailand along with the Tabian Baan, the booklet of the property.

4.7 The House Registration Book – “Tabien Baan”

In Thailand, every property is accompanied with “house registration book”, that you can imagine as a passport for the property.

There is only 1 property in the house registration book. Owner is holding it, if you are an outright owner in freehold terms of your property in Thailand, you might have it in hands.

The house registration book is usually blue, it shall be yellow if the registered owner is a foreigner. If you are the lessor of your property in a long term lease agreement, you might not have the Tabien baan in hands.

Having a property registered in the house registration book will entitle you to lower stamp duty fees in the event when you resale your property within the 5 first years.

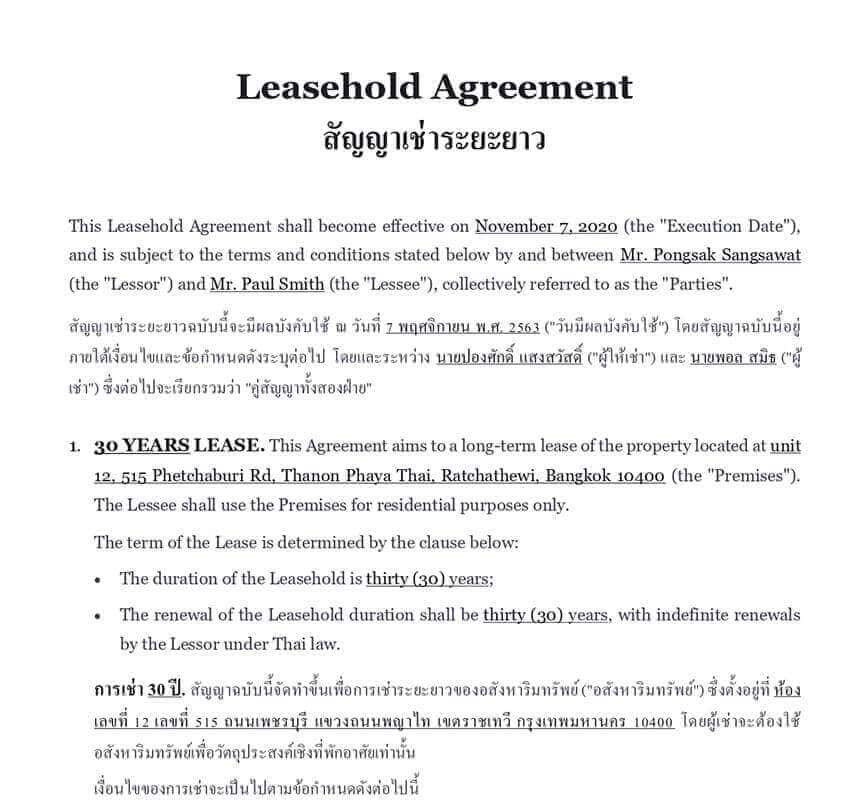

4.8 The Lease agreement

A lease contract has a maximum duration of 30 years by law, renewable up to twice. A lease contract is to be registered at the Land department.

Only when you purchase a property in freehold terms with an outright ownership, will you get a title deed with your name on it, when you purchase a property in leasehold terms, the lease agreement or lease contract – and its conditions – between the Lessor and the Lessee (you) will establish the applicable clauses throughout the term of the lease, including the renewal conditions, the sale and the transfer of the lease, compensations, taxes to be borne by whom, etc., all these details must be part of the lease agreement. It is recommended, but not mandatory, to hire a lawyer to review the lease contract terms to make sure it protects your interests.

5. Taxation on real-estate in Thailand

5.1 Property Sale & Resale fees.

FREEHOLD

LEASEHOLD

Transfer fees ONLY are to be borne by the buyer, and it is a usual practice, but no guaranteed, for those transfer fees to be shared equally between buyer and seller, depending on conditions. All other charges are borne by the Seller. In practice, when you buy a property in Thailand, you might therefore end up paying only 1% transfer fees or 0.50% at the Land department depending on conditions stated about the transfer fees in the Sales and Purchase Agreement.

5.2 Low property tax scheme in Thailand

Thailand is not free of “property tax” as it may exist in other countries but the tax amounts are very low in comparison. Depending on the type of property you own in Thailand, for residential purpose, the “land and new building tax“ starts as low as 0.02% and is capped at max 0.3% of the appraised property value, yearly.

All taxes and fees related to owning a property in Thailand are to be paid at the Land department at the time of registration or transfer of property / lease. ![]() See the official double tax agreement by country

See the official double tax agreement by country

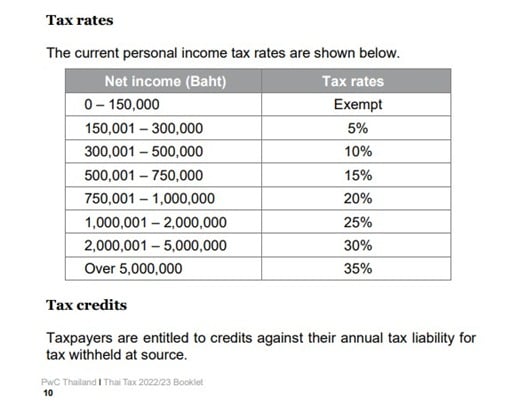

5.3 Personal Income Tax in Thailand

Although, property tax is low, you are to be taxed on the rental incomes generated from your property, if any. The rental revenue would be part of your Personal Income Tax declaration scheme with applicable tax rates calculated as follows if you have a Tax ID in Thailand.

Flat rate of 15% without a Tax ID for foreigners, it is possible to declare and claim a refund at the Revenue Department afterwards.

6. Financing options

It is quite hard for foreigners to obtain a loan from a Thai bank to purchase a property in Thailand. Unless you are a long-term resident and can justify a regular income in Thailand, it will not be possible for you to obtain a loan. Even if you obtain a loan, you might need to comply with foreign ownership policies.

Check out more in the article and see how to obtain a loan from a thai bank for foreigners

7. Visa options

Buying a property in Thailand and obtaining a visa to stay in Thailand in your property are two separate matters. Previously, until September 2023, some Elite Visa packages allowed visa stay with a minimum property investment. These offers are now obsolete and if you would like to stay in Thailand in your property for an extended period of time, you will have to go through the regular visa application processes, otherwise, Elite Visas programs are available for those willing to stay for a longer period in the country or just willing to have special immigration services for few years. Here below the 4 Thailand Elite Visa Membership Programs updated October 2023 : Contact us if you are interested in Elite Visa –

Thailand Gold Membership – 5 years – 900,000 THB

Thailand Platinum Membership – 10 years – 1,500,000 THB

Thailand Diamond Membership- 15 years – 2,500,000 THB

Thailand Reserve Membership – 20 years – 5,000,000 THB

Keller Henson team

Thailand Real Estate Market AnalystsExpert real estate specialists in Thailand, the Keller Henson team offers comprehensive guidance for foreigners buying property. They combine local market knowledge with legal expertise to ensure a secure and efficient investment experience.

Disclaimer

All the information in this guide to buying real estate in Thailand is given for guidance only. Some of the issues raised, such as real estate laws and taxation, may require expert advice and a more detailed, individual study. This article has been prepared in good faith, with the aim of providing information related to how to purchase a property as accurately as possible. Keller Henson cannot be held responsible for misinterpretation, changes or inaccurate information.

FAQ about Purchasing a property in Thailand

What does Freehold vs Leasehold mean in Thailand

To buy a property in Thailand in freehold terms implies outright ownership of the property. Non-residents, foreigners, are allowed to purchase in “foreign freehold” only condominiums, within the “Foreign Quota”, representing a maximum of 49% of the total surface area allocated to foreign freehold ownership in the condominium.

To buy a property in leasehold terms equals to a long term, up to 30-year, lease of the property, renewable once or twice. Houses and villas for sale are in leasehold terms, and you are the Lessee in the lease contract, registered at the Land department. You can renew, sell, transfer your lease as per the conditions agreed in the lease contract.

What is the Thai Land department?

In Thailand, the Land department is the government body in charge of the land registry, and topography. The Land department, with provincial offices through Thailand issues property titles and manages real-estate transactions, as well as taxes and fees settlements.

Can I buy a property from overseas without coming to Thailand?

Absolutely. to purchase a property in Thailand, you don’t need to be physically in Thailand. The reservation, contract arrangements, signatures, and payments can be done from overseas. You are invited to attend to the appointment at the Land department to register your property, but you can always skip this attendance,

Can I register my property at the Land department without coming to Thailand?

Yes, you can register your property at the Land department without coming to Thailand with a Power of Attorney (POA) to a representative, agent, lawyer, who will represent you and take care of the registration at the Land department on your behalf. The PoA form, given by the Land department, is to be notarized in your country of residence within 30 days of the appointment at the Land department for registration.

Can I purchase real estate for investments as a foreigner in Thailand?

Yes, you can invest in properties in Thailand to generate income in several ways.

Hospitality groups are welcoming early investors with below average market price units, and offer rental guarantee programs, with up to 7% ROI yearly.

You can invest in a property and rent it out by yourself or with the help of a rental management company. Some property developers offer advantageous pool rental programs, where rental revenue is pooled among owners and then redistributed equally.

It’s also possible to buy a villa or condominium off-plan, before the project is being completed, at a lower price per sqm than the market price, allowing for flexible payment terms, and substantial capital gains.

Will I pay taxes on my property in Thailand?

All real-estate due taxes in Thailand are settled when you purchase a property at the provincial Land department office. There is a yearly property tax applicable on your property in Thailand, the amount is very low, from 0.02% to 0.3% of the property value per year. You are subject to the Personal Income Tax scheme if you generate revenue with your property, through rentals.

Are there any hidden agency fees or notarial fees when buying a property in Thailand?

No, there are no hidden fees to provision out of what is outlined in this article when you buy a condo or a villa in Thailand.

Do I need a lawyer to assist me when I purchase a property in Thailand?

Decision remains yours, but technically, this is not necessary in all cases, depending on the ownership set up is a condominium in freehold, or a Thai limited company buying a property.

Can Keller Henson recommend Thai legal firms, reliable contractors, designers, etc?

In fact, Keller Henson works with many real estate professionals in Thailand and can recommend companies you can trust, whatever your project is.

What would happen if my overseas bank converted the money into THB already? Will I be able to get freehold ownership when buying property in Thailand?

Yes, it is authorized by the Ministry of Land Affairs under some conditions. Your bank will need to provide a credit memo or credit note via a transfer form. Then, the receiving Thai bank must issue a reference letter containing specific information: confirmation that the money comes from overseas, confirmation that the funds are intended for a real estate purchase, buyer’s name, property details. More info